Tax clearance Malaysia LHDN

Tax clearance Malaysia LHDN

Latest tax audit operasi

IRB has initiated tax audit on the following

1. CP21 - Notification by Employer on Employee's departure from Malaysia

http://phl.hasil.gov.my/pdf/pdfborang/CP21_Pin.1_2021.pdf

2. CP22 - Notification of New Employee

http://phl.hasil.gov.my/pdf/pdfborang/CP22_Pin.1_2021.pdf

3. CP22A - Notification of Cessation of Employment

http://phl.hasil.gov.my/pdf/pdfborang/CP22A_Pin.1_2021.pdf

Penalty on non-compliance on CP21, CP22 & CP22A

Delay in submitting the application for tax clearance may be subjected to penalty. The penalty will be in the form of fines between MYR 200 and MYR 20,000 and imprisonment for up to six months.

LHDN may take legal action against the employer who fails to pay the outstanding tax as per the Tax Clearance Letter.

How to submit CP21 + CP 22A online via IRB e-SPC.

STEP 1: Go to LHDN Website: https://ez.hasil.gov.my (网站)~ Key in New IC number

STEP 2: Key in password

STEP 3: Select e-SPC

STEP 4: Key in Employer’s number

STEP 5: Select Form and Key in accordingly

CP22A – Private (私人公司)

CP22B – Government (政府)

CP21 – Foreign Leaver (外国人)

STEP 7: Select Log Out

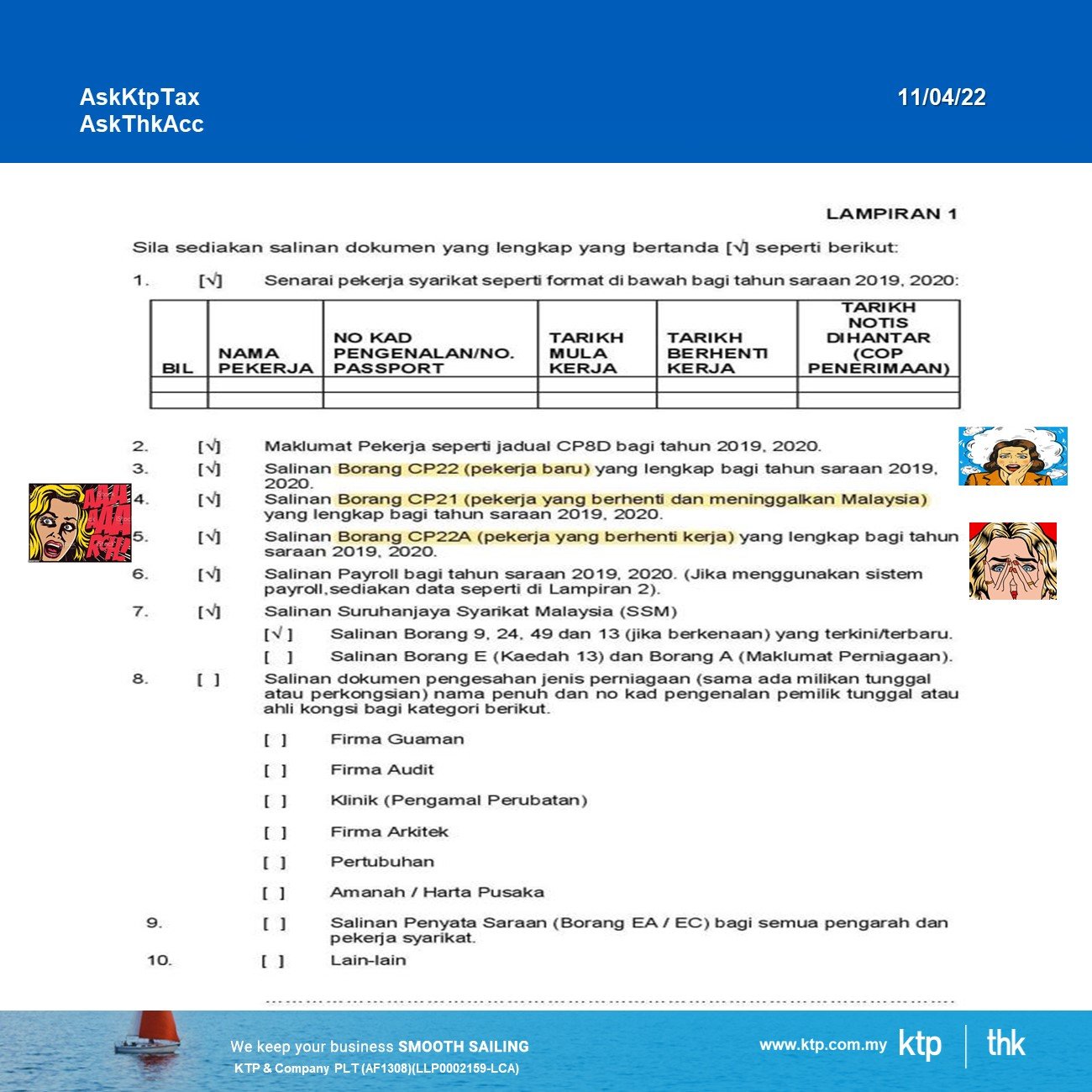

What documents IRB ask for?

Basically these are the documents required in a typical tax audit on employer on CP21, CP22 & CP22A :

•Staff listing

•Form E – Return of C.P.8D

•Form 22

•Form 21

•Form 22A

•Payroll System Data

•Latest of Form 9, 24,49 and 13

•Borang D(Kaedah 13)and Borang A(Maklumat Perniagaan)

•Form EA/EC

Read our past articles on various CP forms

1. Employer Tax Obligation under Income Tax Act - Resignation & New Employee dated 12/01/21

2. How to submit CP21 + CP 22A online via IRB e-SPC. dated 29/01/21

3. IRB tax audit on employers on CP21, CP22 & CP22A dated 1/2/21

4. CP 21 CP22 CP22A CP22B LHDN dated 29/12/21

5. 为什么所得税发布 2021 年 10 月 1 日 发布雇主审计框架 (Audit Framework for Employers) ? dated 7/10/21

6. Employer Tax Audit Framework dated 13/10/21

Visit Us

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

Website www.ktp.com.my

Instagram https://bit.ly/3jZuZuI

Linkedin https://bit.ly/3sapf4l

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

Website www.thks.com.my

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

Tiktok http://bit.ly/3u9LR6Q

Youtube http://bit.ly/3ppmjyE

Facebook http://bit.ly/3ateoMz

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

Instagram https://bit.ly/3u2PxHg

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Archive

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- November 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016