Personal Income Tax Relief 2021 Malaysia

Personal Income Tax Relief 2021 Malaysia

It is tax season whereby taxpayers are to file tax returns and pay taxes accordingly. Other than truthfully declaring your income and reliefs, and submitting your tax files before the deadline stipulated by LHDN, taxpayers are also responsible for record-keeping.

.What is the 2021 personal deduction?

With that, here’s the full list of tax reliefs for YA 2021.

1.Individual and dependent relatives - RM9,000

2. Medical treatment, special needs and carer expenses for parents (Medical condition certified by medical practitioner) - RM8,000 (Restricted)

3. Purchase of basic supporting equipment for disabled self, spouse, child or parent - RM6,000 (Restricted)

4. Disabled individual - RM6,000

5.Education fees (Self)

Other than a degree at masters or doctorate level - Course of study in law, accounting, islamic financing, technical, vocational, industrial, scientific or technology

Degree at masters or doctorate level - Any course of study

Any course of study undertaken for the purpose of up-skilling or self-enhancement recognized by the Director General of Skills Development under the National Skills Development Act 2006 – effective from YA 2021 until YA 2022. (Restricted to RM1,000)

RM7,000 (Restricted)

6. Medical expenses for serious diseases for self, spouse or child - RM8,000 (Restricted)

7. Medical expenses for fertility treatment for self or spouse

8. Vaccination expenses for self, spouse and child. Types of vaccines which qualify for deduction are as follows:

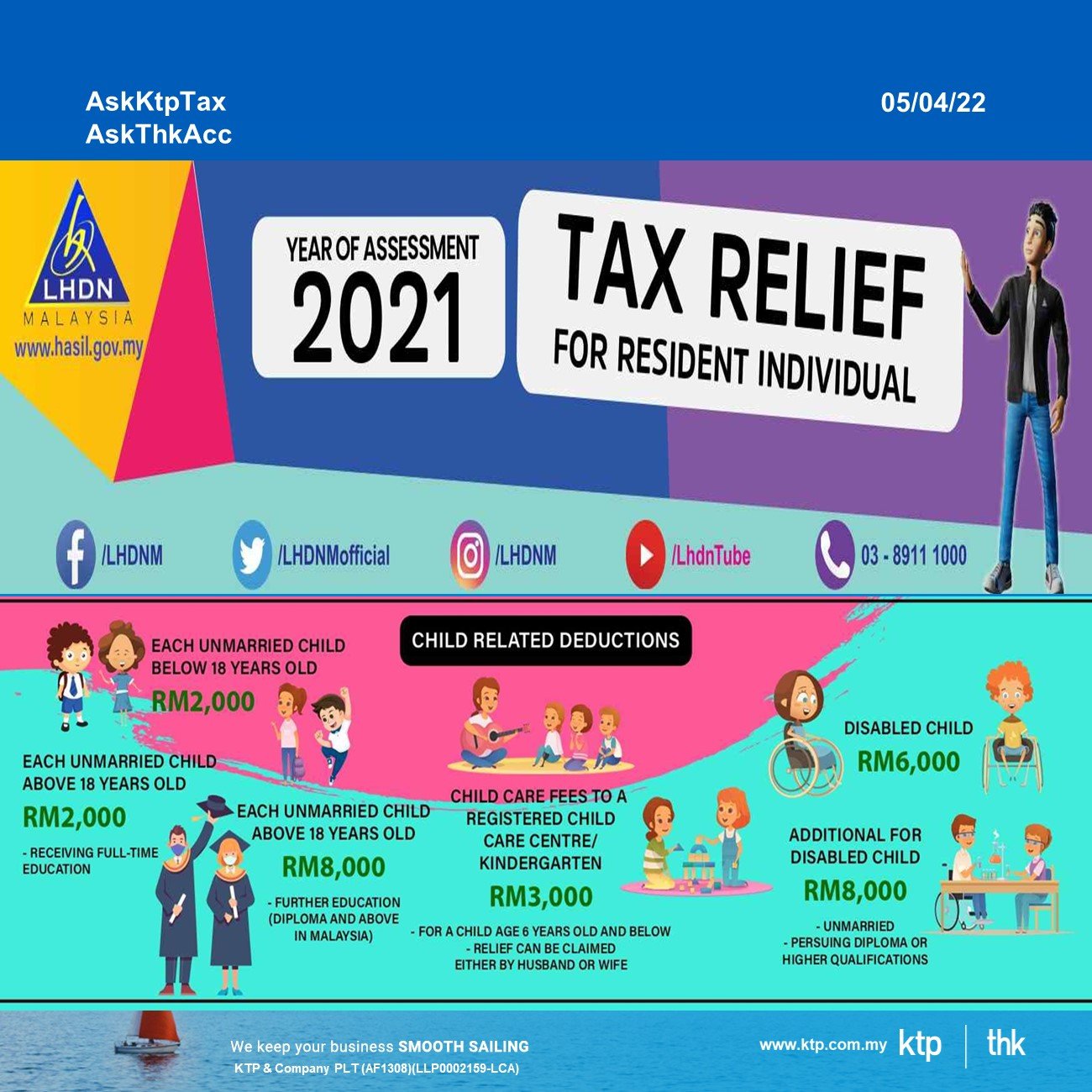

Pneumococcal;

Human papillomavirus (HPV);

Influenza;

Rotavirus;

Varicella;

Meningococcal;

TDAP combination ( tetanus-diphtheria-acellular-pertussis); and

Coronavirus Disease 2019 (Covid-19)

RM1,000 (Restricted)

9 (i) Complete medical examination for self, spouse, and child as defined by the Malaysian Medical Council (MMC).

(ii) COVID-19 detection test including purchase of self detection test kit for self, spouse, child.

RM1,000 (Restricted)

10. Lifestyle – Expenses for the use / benefit of self, spouse or child in respect of:

purchase and subscription of books / journals / magazines / newspapers (including electronic subscription) / other similar publications (Not banned reading materials)

purchase of personal computer, smartphone or tablet (Not for business use)

purchase of sports equipment for sports activity defined under the Sports Development Act 1997 and payment of gym membership

payment of monthly bill for internet subscription (Under own name)

RM2,500 (Restricted)

11. Lifestyle – Purchase of personal computer, smartphone or tablet for self, spouse or child and not for business use

This deduction is an addition to the deduction granted under item 10.

RM2,500 (Restricted)

12. Purchase of breastfeeding equipment for own use for a child aged 2 years and below (Deduction allowed once in every 2 years of assessment) - RM1,000 (Restricted)

13. Payment for child care fees to a registered child care centre / kindergarten for a child aged 6 years and below - RM3,000 (Restricted)

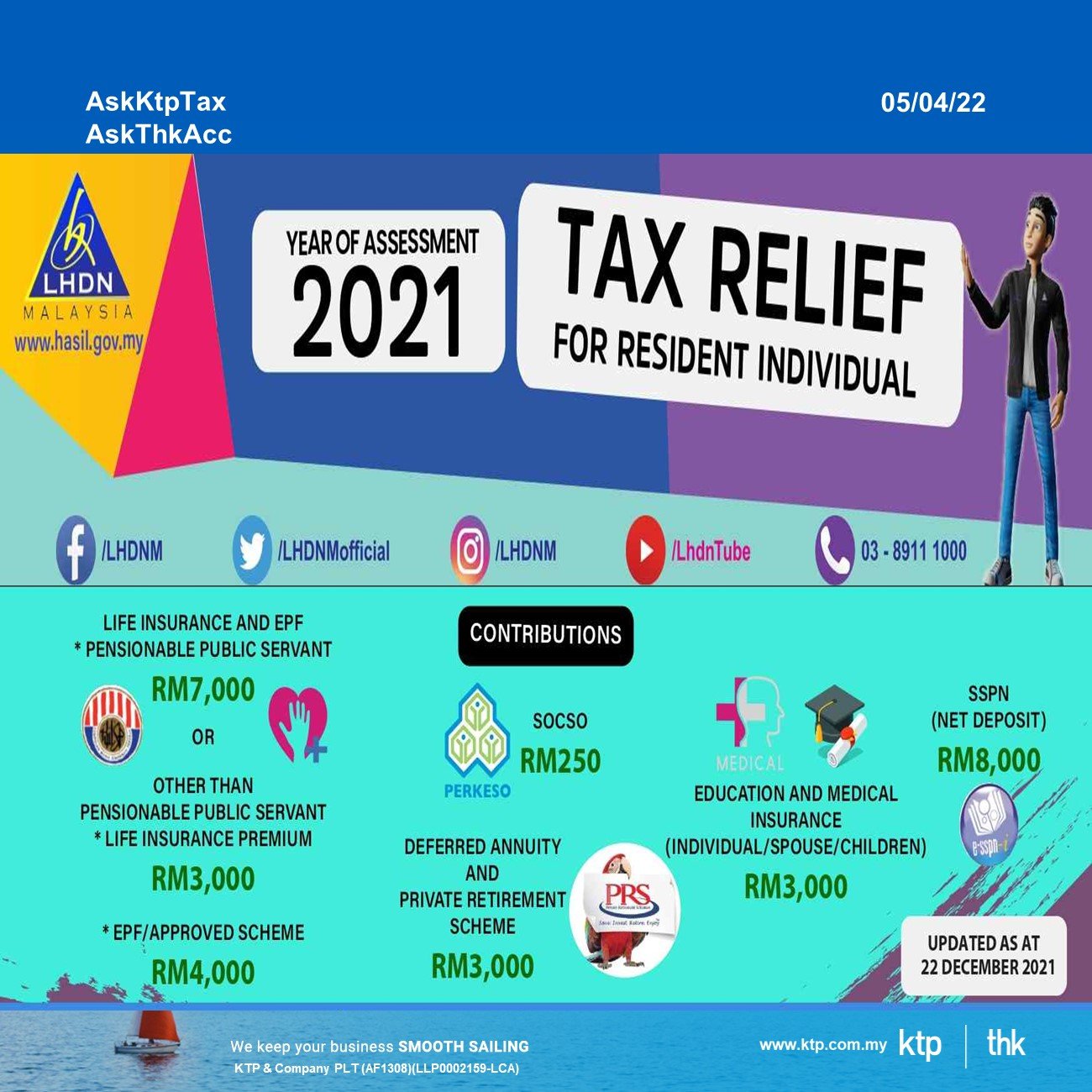

14. Net deposit in Skim Simpanan Pendidikan Nasional (Net deposit is the total deposit in 2021 MINUS total withdrawal in 2021) - RM8,000 (Restricted)

15. Husband / wife / payment of alimony to former wife- RM4,000 (Restricted)

16. Disabled husband / wife - RM5,000

17. Each unmarried child and under the age of 18 years old- RM2,000

18. Each unmarried child of 18 years and above who is receiving full-time education ("A-Level", certificate, matriculation or preparatory courses).

RM2,000

19. Each unmarried child of 18 years and above that:

receiving further education in Malaysia in respect of an award of diploma or higher (excluding matriculation/ preparatory courses).

receiving further education outside Malaysia in respect of an award of degree or its equivalent (including Master or Doctorate).

the instruction and educational establishment shall be approved by the relevant government authority.

RM8,000

20. Disabled child - RM6,000

Additional exemption of RM8,000 disable child age 18 years old and above, not married and pursuing diplomas or above qualification in Malaysia @ bachelor degree or above outside Malaysia in program and in

Higher Education Institute that is accredited by related Government authorities

RM8,000

21. Life insurance and EPF INCLUDING not through salary deduction

Pensionable public servant category

Life insurance premium

OTHER than pensionable public servant category

Life insurance premium (Restricted to RM3,000)

Contribution to EPF / approved scheme (Restricted to RM4,000)

RM7,000 (Restricted)

22. Deferred Annuity and Private Retirement Scheme (PRS) - with effect from year assessment 2012 until year assessment 2025 - RM3,000 (Restricted)

23. Education and medical insurance (INCLUDING not through salary deduction) - RM3,000 (Restricted)

24. Contribution to the Social Security Organization (SOCSO) - RM250 (Restricted)

25. Payment for accommodation at premises registered with the Commissioner of Tourism and entrance fee to a tourist attraction

(Expenses incurred on or after 1st March 2020 until 31st December 2021)

Registered accomodation premises can be check thru link of : http://www.motac.gov.my/en/check/registered-hotel

RM1,000 (Restricted)

26. Additional lifestyle tax relief related to sports activity expended by that individual for the following:

Purchase of sport equipment for any sports activity as defined under the Sport Development Act 1997 (excluding motorized two-wheel bicycles);

Payment of rental or entrance fee to any sports facility; and

Payment of registration fee for any sports competition where the organizer is approved and licensed by the Commissioner of Sports under the Sport Development Act 1997.

RM500 (Restricted)

Visit Us

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

Website www.ktp.com.my

Instagram https://bit.ly/3jZuZuI

Linkedin https://bit.ly/3sapf4l

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

Website www.thks.com.my

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

Tiktok http://bit.ly/3u9LR6Q

Youtube http://bit.ly/3ppmjyE

Facebook http://bit.ly/3ateoMz

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

Instagram https://bit.ly/3u2PxHg

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Archive

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- November 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016