Main Changes in GST Return and Tax Code

eKTP 57

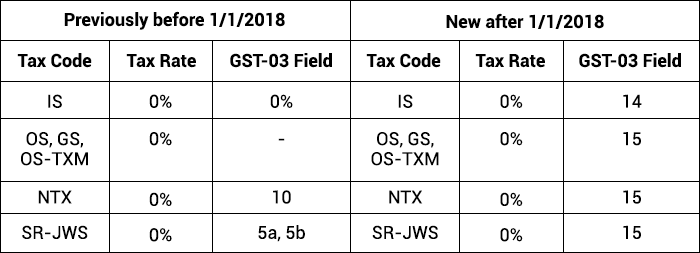

Main Changes in GST-03 and Tax Code with effective from 1/1/2018

Announcement from RMC

Please be informed that, with effect from 1 January 2018, details in item 15 of GST-03 return will be amended from "Total Value of GST Suspended under Item 14" to "Total Value of Other Supplies". Other supplies in this item refer to ALL SUPPLIES OTHER THAN SUPPLIES DECLARED IN ITEM 5, 10, 11, 12, 13, 14, 16, 17, 18 in the GST-03 return. Other supplies also include disregarded supplies and out of scope supplies. Details of other supplies will be updated in the Accounting Software Guide.

Change in tax codE

Create new tax code with IM-CG *

Delete tax code with NP

Consolidate ZP, GP, RP & EP into ZP **

GST-03 update

Field 6a changes

Include new tax code IM-CG together with TX, TX-CG, TX-IES, TX-RE, IM, TX-FRS, TX-ES

Field 6b changes

Include new tax code IM-CG together with TX, TX-CG, TX-IES, TX-RE, IM, TX-FRS, TX-ES

Field 10 changes

Show only ZRL (exclude NTX previously)

Field 15 changes

Show OS, OS-TXM, GS, NTX, SR-JWS (instead of Field 14 x 6% previously)

Field 16 changes

Include IM-CG together with TX-CG

Archive

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- November 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016